5 Common Fundraising Requirements and How to Stay Compliant

January 12, 2024As a nonprofit professional, you might assume that successful fundraising is all about getting to know your donors and hosting engaging events. While these elements of fundraising can greatly impact the amount you’re able to raise, there’s another important factor to consider: compliance.

You know that your nonprofit must adhere to the IRS’s rules for financial reporting, but are you familiar with the fundraising requirements you must follow? In this guide, we’ll cover five fundraising requirements and how your nonprofit can maintain compliance while garnering support for its cause.

1. Charitable Solicitations Registration

Before soliciting donations, most nonprofits must register for charitable solicitations with their state. If your nonprofit solicits donations in one of the 40 states with a registration requirement, you should complete your charitable solicitations registration before raising even a dollar.

“Solicitation” of donations refers to nearly every fundraising activity, including:

- Fundraising events: These may include auctions, galas, or any other event your nonprofit hosts to raise support for its cause.

- Participation fees: When your nonprofit hosts an activity and charges a fee to participate, the activity is considered a fundraiser. For example, you may charge a race entry fee for a 5k run or sell tickets to a gala.

- Product sales: Any merchandise your nonprofit sells, such as branded t-shirts or hats, qualifies as product sales. According to ABC Fundraising, some of the top product fundraising ideas include scratch cards, spinners, travel mugs, and candles.

Your nonprofit must register with every state that requires it if you’ll be soliciting donations there. For example, if your organization is based in Georgia but also solicits donations in Florida, you’ll need to register in both states. Then, you’ll have to renew this registration each year to remain compliant.

2. Tax Deductibility

Official 501(c)(3) status grants tax exemption to your nonprofit, but donations can also be deducted from donors’ taxes. However, eligibility for deduction varies depending on the type of donation submitted, which is why your nonprofit should communicate the tax-deductible eligibility of each donation.

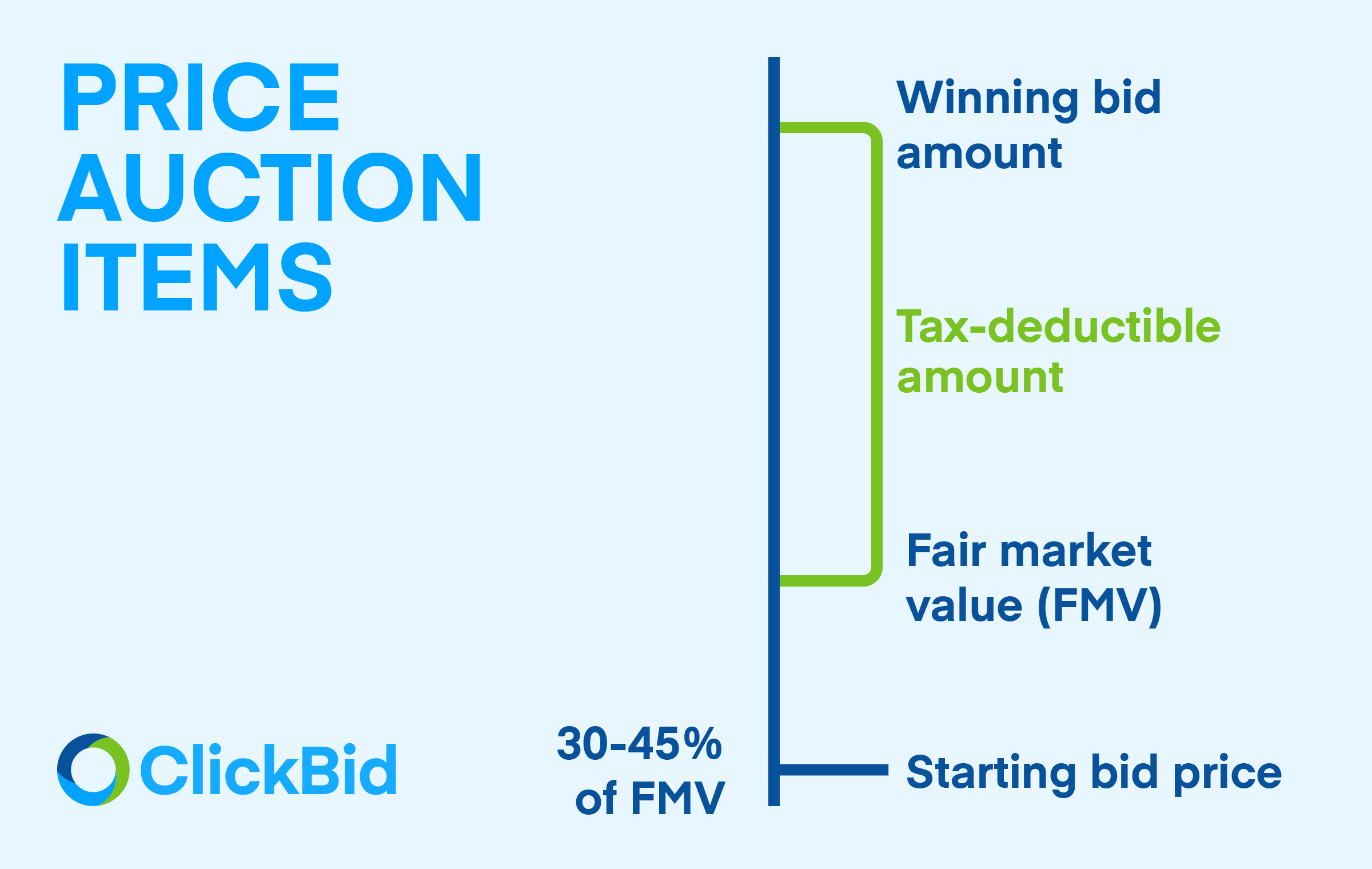

For example, let’s say your nonprofit hosts an auction fundraiser. Your nonprofit collects the winning bid for an auction item as a donation, but only the amount paid above the item’s fair market value (FMV) counts as tax deductible.

Using auction software to manage your fundraiser can help you keep track of each item’s FMV and winning bid amount. Plus, you can use the tool to automate donation receipts so that winning bidders have a record of their transactions, as well.

3. Allocation of Funds

Among the diverse sources of revenue your nonprofit receives, donations are often the most flexible. Whereas your nonprofit knows what funds will be used for during the process of obtaining a grant, organizations can use general donations in various ways—unless donors make a specific request about the use of their gift.

Restricted donations are gifts that donors contribute for a specific purpose. If a donor gives $100 to feed the animal shelter’s dogs, for example, that $100 must be used on dog food. However, unrestricted gifts may be used for any of your nonprofit’s expenses, such as your overhead costs or marketing expenses.

When planning a fundraiser, determine how you’ll use the resulting funds ahead of time to ensure you properly allocate them. You can categorize these contributions in the following ways:

- Cash donations: This is the most common type of donation, including donations made through online portals, in person via cash or checks, matching gift programs, grants, and other contribution methods.

- In-kind donations: This is a non-cash gift in the form of goods or services that could benefit your nonprofit. For example, auction items donated to your fundraiser are considered in-kind donations.

- Securities: This includes stocks, bonds, or other securities donated to your nonprofit.

Be sure to record restricted funds separately in your nonprofit’s books. This step helps you view those funds as “untouchable” to avoid misappropriating any donations. Effective bookkeeping can also help you gain valuable insights about your fundraising success, which you can use to adjust your approach in the future and raise more in your next campaign.

4. Games of Chance

When someone pays money to participate in a game with the hopes of winning something, the activity is referred to as a game of chance. Fundraisers can sometimes fall into this category, and to maintain fundraising compliance, you’ll need to know your state’s rules regarding these games.

In fact, 41 states require licenses for nonprofits to host games of chance. Some don’t allow charitable organizations to host games of chance at all. If your nonprofit is eligible for a license, you’ll likely need to submit the following to the appropriate office in your state:

- Application for license

- Articles of incorporation

- Bylaws

- List of organization’s officers

- Location of the gaming events

- Application fee

Before planning an auction, raffle, or other fundraiser that could be considered a game of chance, familiarize yourself with the requirements in your nonprofit’s home state. Preparing this application in advance can save your nonprofit the time and trouble of applying while also planning a fundraiser.

5. Form 990

Your nonprofit’s finances are at the heart of most compliance issues since your operations depend solely on charitable donations. The IRS will only uphold your 501(c)(3) status if your nonprofit uses its funds for its charitable purpose, and to prove this, you must file Form 990 annually.

According to Foundation Group’s Form 990 filing guide, there are a few ways your nonprofit can prepare for this filing:

- Record your finances: Use bookkeeping software or outsource the task to a professional to ensure you keep accurate and up-to-date records of your nonprofit’s financial activity.

- Track donor data: The IRS requires information about your nonprofit’s biggest contributors, making donor data tracking a crucial part of preparing for Form 990.

- Document your activities: Detail your nonprofit’s accomplishments by recording its programs, funding for programs, and the results of its work.

Donations are often a direct result of your fundraising efforts, so to maintain fundraising compliance, you’ll need to handle your finances with care. If you’re unsure how to properly manage your finances or report information to the IRS, outsource the task to a professional bookkeeper or compliance specialist.

Evaluate your current fundraising strategy to ensure it aligns with state and federal regulations. Then, as you plan future fundraisers, ensure your activities and solicitations comply with these requirements. By carefully planning your fundraisers, you’ll remain compliant and raise more with thoughtful and strategic fundraising efforts!

Get The Latest Updates

Subscribe To Our Monthly Newsletter

No spam, notifications only about new products, updates.

Related Posts

Become a subscriber

Subscribe to our blog and get the latest updates straight to your inbox.